Demystifying Staking in Crypto: How It Works and Why It’s a Game-Changer

Unlocking the Power of Staking in Crypto: 7 Reasons Why It's a Must-Try

In the ever-evolving landscape of cryptocurrency, new investment opportunities and strategies continue to emerge. One such strategy that has gained significant popularity is staking. This article will delve into the concept of staking in crypto, how it operates, and why it has become a game-changer for crypto enthusiasts and investors alike.

What Is Staking in Crypto?

Staking in the world of cryptocurrency refers to the process of participating in the validation and security of blockchain networks by holding and “staking” a certain amount of digital assets as collateral. This practice helps maintain the integrity and functionality of the blockchain network while offering participants rewards in the form of additional cryptocurrencies.

How Does Staking Work?

Staking is closely associated with Proof of Stake (PoS) and Delegated Proof of Stake (DPoS) consensus mechanisms. Here’s a step-by-step breakdown of how staking works:

Select a Supported Cryptocurrency:

To participate in staking, you need to choose a cryptocurrency that supports this feature. Notable examples include Ethereum 2.0 (ETH), Cardano (ADA), and Polkadot (DOT).

Acquire the Cryptocurrency:

Obtain the cryptocurrency you wish to stake through a cryptocurrency exchange or other reputable sources.

Choose a Staking Platform:

Select a staking platform or wallet that supports the specific cryptocurrency you want to stake. Ensure the platform is secure and reputable.

Stake Your Tokens:

Transfer your chosen cryptocurrency to the staking platform or wallet. This process typically involves locking up a certain amount of tokens as collateral.

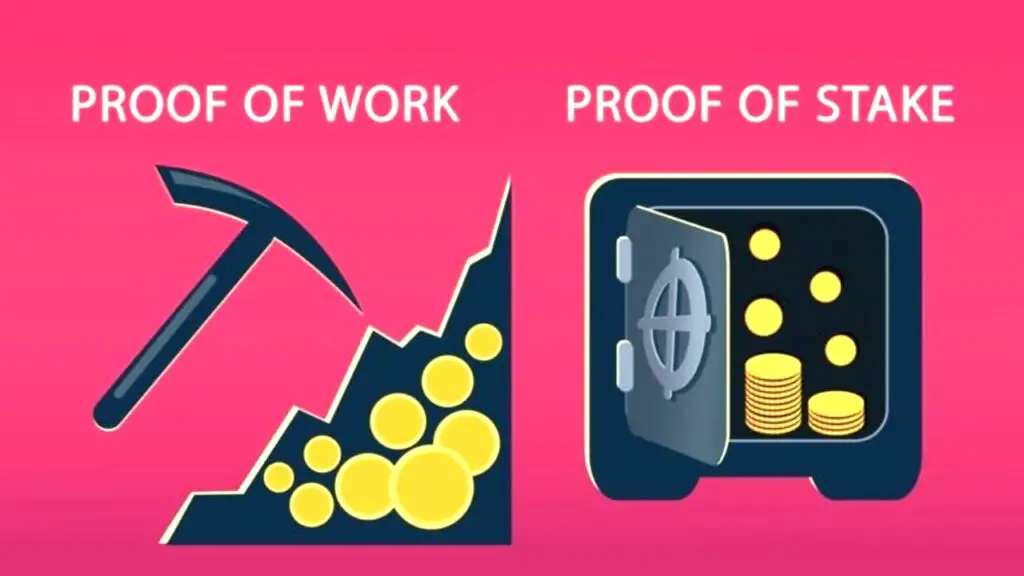

Participate in Network Validation:

Your staked tokens are now used to validate transactions and secure the blockchain network. This helps in achieving consensus without the need for energy-intensive mining.

Earn Rewards:

As a speaker, you are rewarded with additional tokens for your participation in network security. Rewards are distributed regularly, usually based on factors like the amount staked and the duration of staking.

Monitor and Manage:

Keep an eye on your staked assets and make informed decisions based on market conditions and the rewards you are receiving.

Why Staking Is a Game-Changer

Staking has become a game-changer in the crypto space for several compelling reasons:

Passive Income:

Staking allows you to earn passive income by simply holding and staking your cryptocurrencies. This is an attractive feature for investors seeking consistent returns.

Energy Efficiency:

Unlike Proof of Work (PoW) mining, which is energy-intensive, staking is environmentally friendly as it doesn’t require massive computational power.

Enhanced Security:

Stakers play a vital role in securing blockchain networks, making them more resistant to attacks and fraud.

Liquidity:

Staked assets can often be unstacked relatively quickly, providing liquidity when needed, unlike traditional investments like real estate.

Participation in Governance:

Some staking networks grant participants the ability to influence network decisions through governance proposals.

Diversification:

Staking allows you to diversify your crypto portfolio, potentially reducing risk.

Long-Term Potential:

Many believe that staking represents the future of blockchain technology, making it a long-term investment with growth potential.

FAQs

Is staking safe?

Yes, staking is generally safe when done on reputable platforms. However, like all investments, there are risks involved, such as smart contract vulnerabilities or changes in network consensus rules. Conduct thorough research and choose reliable staking platforms to minimize risks.

How much can I earn through staking?

Earnings from staking vary depending on factors like the cryptocurrency you stake, the network’s reward structure, and the amount you stake. Annual returns can range from a few percent to over 10% or more.

Can I unstake my tokens anytime?

Most staking platforms have specific unstaking periods, during which your tokens are locked. These periods can range from a few hours to several weeks, depending on the network. Be sure to check the unstaking terms before staking your assets.

Are staking rewards taxable?

Staking rewards may be subject to taxation in some jurisdictions. It’s essential to understand the tax regulations in your country and report your crypto earnings accordingly.

What happens if the cryptocurrency I stake loses value?

If the cryptocurrency you stake experiences a significant price drop, your staked assets may be at risk. However, this risk is inherent in all crypto investments. It’s crucial to consider your risk tolerance and diversify your portfolio accordingly.

Conclusion

Staking in crypto has emerged as a revolutionary investment strategy that combines the potential for passive income with environmental sustainability and network security. By understanding how staking works and its many advantages, you can make informed decisions about integrating this strategy into your cryptocurrency portfolio. Staking is not only changing the way we invest in digital assets but also reshaping the future of blockchain technology. Explore the world of crypto staking and unlock its potential today.