Unlocking the Power of Insurance in Estate Planning: 7 Crucial Insights

What is estate planning and how can life insurance help?

Estate planning is an essential aspect of securing your financial future and ensuring your loved ones are taken care of after you’re gone. While many people associate estate planning with wills, trusts, and distribution of assets, there’s a powerful tool that often goes overlooked – insurance. In this comprehensive guide, we will explore the pivotal role of insurance in estate planning and provide you with valuable insights on optimizing your plan for a secure future.

The Intersection of Insurance and Estate Planning:

Leveraging the Synergy

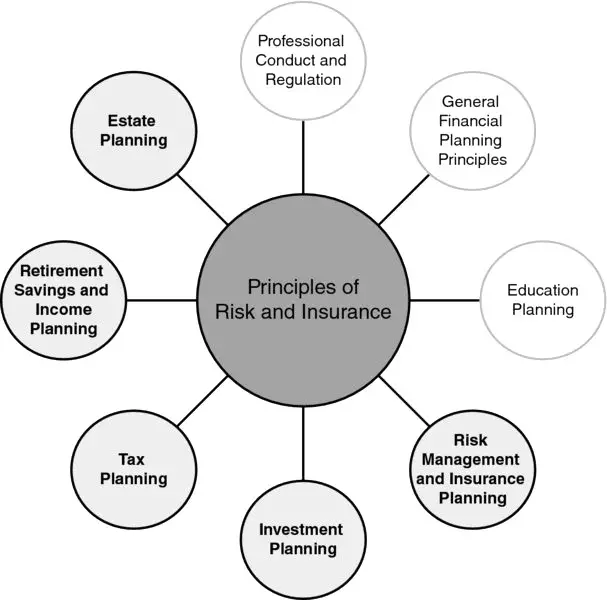

At the heart of successful estate planning lies the synergy between insurance and traditional estate planning tools. Insurance products, such as life insurance and disability insurance, can safeguard your assets and provide financial security to your heirs in various ways. We’ll delve into how these policies can complement your estate plan.

Securing Your Loved Ones:

A Safety Net for Your Family

Life insurance is a powerful tool in estate planning. It ensures that your family is financially secure even in your absence. We’ll discuss the different types of life insurance policies and how to determine the right coverage amount for your specific situation.

Tax-Efficient Estate Planning:

Minimizing Taxation

Estate taxes can erode a significant portion of your assets. We’ll explore how life insurance and other insurance strategies can be used to mitigate estate taxes and preserve your wealth for your heirs.

Business Succession Planning:

Protecting Your Business Legacy

If you own a business, insurance can play a pivotal role in ensuring a smooth transition to the next generation or business partners. We’ll outline strategies for using insurance to facilitate business succession planning.

Long-Term Care and Disability Insurance:

Preserving Your Estate in Times of Need

Disability insurance and long-term care insurance are crucial components of estate planning, especially as you age. Discover how these policies can protect your estate by covering healthcare and long-term care costs.

Beneficiary Designations and Estate Planning:

The Importance of Precision

Your estate plan’s success heavily depends on the accuracy of beneficiary designations. We’ll guide you through the process of aligning your insurance policies with your overall estate planning goals.

Frequently Asked Questions:

Q: Can life insurance be part of my will?

A: No, life insurance policies are not typically part of a will. They have separate beneficiary designations. Ensure that your beneficiaries are up to date.

Q: How can insurance help in reducing estate taxes?

A: Life insurance proceeds can be used to cover estate taxes, preventing the need to sell off assets. Speak with a financial advisor to create a tax-efficient strategy.

Q: Is it necessary to update my insurance policies regularly in my estate plan?

A: Yes, regular policy reviews are essential. Life events such as marriage, divorce, or the birth of children may necessitate policy adjustments.

Q: What are the key roles of insurance?

Insurance plays several crucial roles in personal and financial well-being. Its key roles include providing financial protection, risk management, and peace of mind. It acts as a safety net, helping individuals and businesses mitigate the financial impact of unforeseen events, such as accidents, illnesses, natural disasters, and more. Additionally, insurance promotes economic stability by spreading the financial burden across a pool of policyholders, thus preventing catastrophic financial losses for any one individual or entity.

Conclusion:

In the intricate world of estate planning, insurance emerges as a powerful tool that can bolster the security of your legacy. By strategically integrating insurance into your estate plan, you can protect your loved ones, minimize tax liabilities, and ensure a smooth transition of assets. Don’t underestimate the role of insurance in securing your financial future.

Appreciate the recommendation. Will try it out.