Insurance scheme for Gig Workers a non-starter – Kat Technical

Maximizing Title Insurance Benefits for Gig Workers: A Comprehensive Guide

Gig Workers: In today’s ever-evolving gig economy, where freelance and contract work are becoming increasingly prevalent, ensuring financial security and protection is paramount. Gig workers, often overlooked in traditional insurance schemes, face unique challenges when it comes to safeguarding their livelihoods. Amidst this landscape, Title Insurance emerges as a crucial yet often underutilized tool for gig workers seeking to mitigate risks and secure their assets.

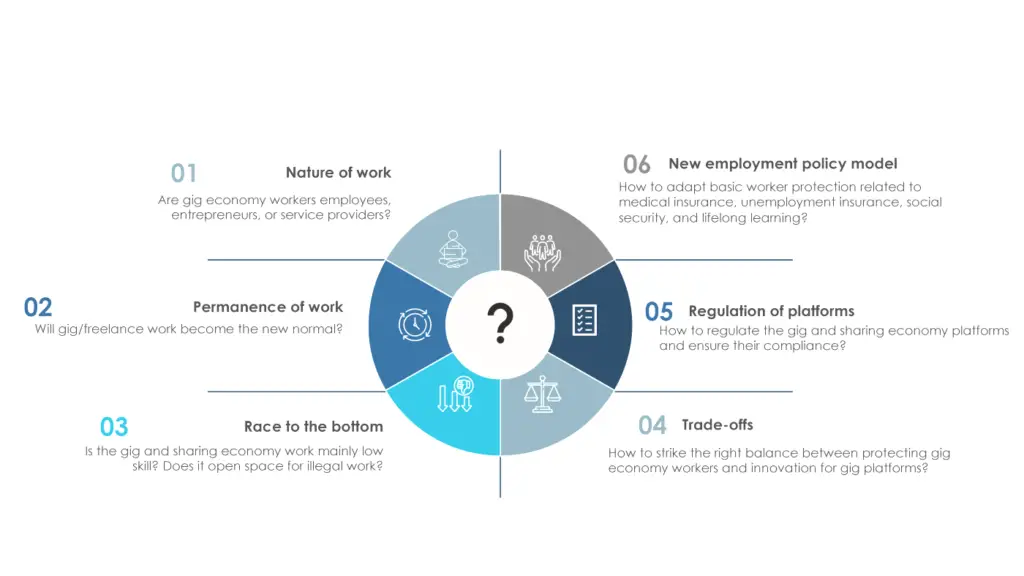

Understanding the Gig Economy Landscape

Before delving into the intricacies of Title Insurance for gig workers, it’s essential to grasp the dynamics of the gig economy. In this modern workforce paradigm, individuals opt for temporary, flexible arrangements over traditional full-time employment. From rideshare drivers to freelance writers, gig workers span various industries, enjoying autonomy and flexibility but also facing uncertainty regarding income stability and benefits.

The Significance of Title Insurance for Gig Workers

Title Insurance, a form of indemnity insurance, traditionally associated with real estate transactions, offers substantial benefits for gig workers. While its primary purpose is to protect property owners and lenders against financial loss due to defects in title, its applicability extends to freelance professionals who rely on intellectual property rights and contractual agreements.

Mitigating Risks in Intellectual Property Transactions

For gig workers, especially those in creative fields such as graphic design, writing, or software development, intellectual property (IP) is their most valuable asset. Title Insurance safeguards against potential challenges to the ownership or validity of IP rights, providing peace of mind and financial protection against costly legal disputes.

Ensuring Contractual Clarity and Compliance

In the gig economy, contracts serve as the foundation of working relationships between independent contractors and clients. However, contractual disputes and ambiguities can arise, leading to financial liabilities and reputational damage. Title Insurance helps gig workers navigate contractual complexities by ensuring clarity, compliance, and enforceability, thereby minimizing the risk of disputes.

Protecting Against Liabilities and Financial Losses

Despite their autonomy, gig workers are not immune to liabilities and financial risks. Whether it’s a breach of contract, professional negligence, or unforeseen legal claims, the financial consequences can be significant. Title Insurance provides a layer of protection against such risks, covering legal expenses, damages, and settlements, thereby safeguarding the financial well-being of gig workers.

How Gig Workers Can Leverage Title Insurance

Now that we’ve established the importance of Title Insurance for gig workers, let’s explore practical strategies for leveraging this invaluable tool to maximize benefits and mitigate risks effectively.

Conducting Due Diligence Before Entering Contracts

Before entering into any contractual agreements or intellectual property transactions, gig workers should conduct thorough due diligence. This includes researching the history of ownership, identifying potential title defects, and assessing the validity and enforceability of contracts. Title Insurance companies offer comprehensive title searches and examinations, empowering gig workers to make informed decisions and mitigate risks proactively.

Securing Comprehensive Title Insurance Policies

When it comes to Title Insurance, not all policies are created equal. Gig workers should opt for comprehensive coverage tailored to their specific needs and risk profiles. This includes coverage for intellectual property rights, contractual disputes, professional liabilities, and legal expenses. By investing in robust Title Insurance policies, gig workers can safeguard their assets and livelihoods against a wide range of risks and contingencies.

Seeking Professional Guidance and Advice

Navigating the intricacies of Title Insurance and contractual agreements can be daunting for gig workers, especially those unfamiliar with legal jargon and nuances. Seeking guidance from experienced insurance professionals, attorneys, or consultants can provide invaluable insights and ensure optimal coverage. These experts can help gig workers assess their risk exposure, tailor insurance solutions, and negotiate favorable contract terms, maximizing the benefits of Title Insurance.

Conclusion

In conclusion, Title Insurance represents a powerful yet often overlooked resource for gig workers seeking to protect their assets and mitigate risks in the ever-evolving gig economy. By understanding the significance of Title Insurance, leveraging comprehensive coverage, and seeking professional guidance, gig workers can safeguard their financial well-being and thrive in a dynamic and competitive landscape.