A Comparison of Construction Surety Bond and Insurance

From Commitment to Coverage: A Comparative Study of Construction Bonds and Insurance

Construction surety bonds: offer financial security and assurance for project owners, contractors, and subcontractors. These bonds guarantee project completion, payment to vendors, and adherence to contractual obligations, mitigating risks in the construction industry

Purpose:

Performance Bonds: These ensure that a contractor completes a project according to the terms of the contract.

Payment Bonds: Guarantees that subcontractors, laborers, and suppliers are paid appropriately by the contractor.

Bid Bonds: Ensures that a contractor will enter into a contract if awarded a bid.

Function:

Financial Guarantee: Surety bonds act as a financial guarantee to project owners or government entities.

Risk Transfer: They transfer the risk of project non-completion or non-payment from the project owner to the surety bond issuer.

Parties Involved:

Principal:

The contractor who purchases the bond.

Obligee:

The entity that requires the bond (project owner or government agency).

Surety:

The bond issuer guarantees the contractor’s performance.

Claims Process:

If the contractor fails to fulfill their obligations, the obligee can file a claim against the bond, and the surety will investigate. If the claim is valid, the surety will compensate the obligee, but the contractor must repay the surety.

Construction Insurance:

Purpose:

General Liability:

Protects against bodily injury, property damage, or negligence claims.

Workers’ Compensation:

Provides coverage for work-related injuries or illnesses for employees.

Builder’s Risk Insurance:

Covers damage to buildings or structures during construction.

Function:

Risk Transfer:

Insurance policies transfer risk from the insured party to the insurance company.

Financial Protection:

Insures against unforeseen events or accidents that may occur during construction.

Parties Involved:

Insured:

The party purchasing the insurance policy.

Insurer:

The insurance company provides coverage.

Claims Process:

In the event of an incident covered by the policy, the insured party files a claim with the insurance company. If the claim is approved, the insurer pays out the agreed-upon coverage amount.

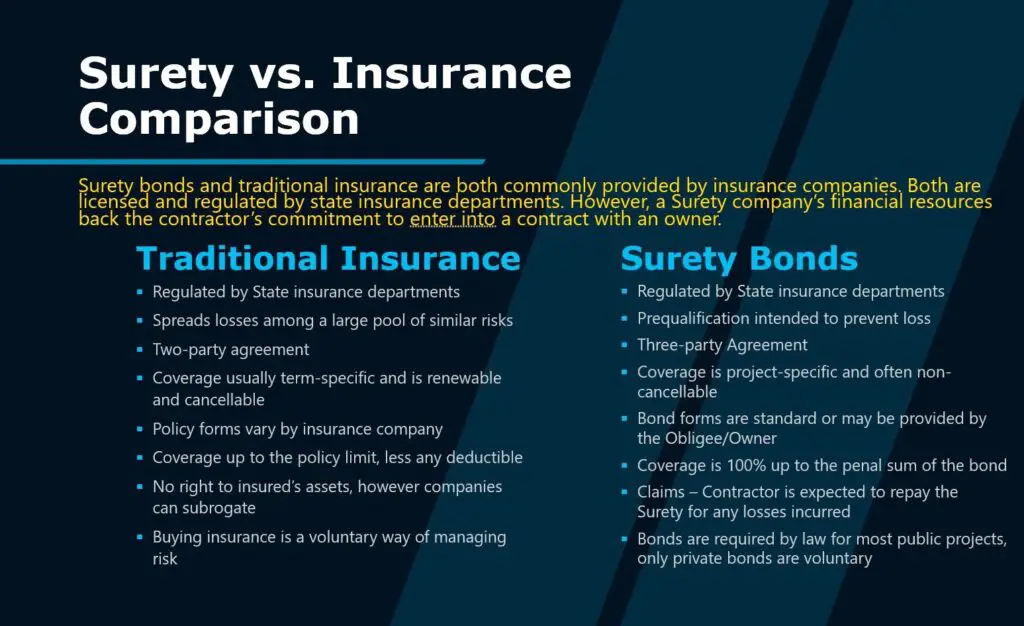

Key Differences:

Risk Transfer Mechanism:

Surety bonds transfer risk to the contractor, who remains ultimately responsible, while insurance transfers risk to the insurance company.

Payment Obligation:

Bonds may require repayment by the contractor for any claims paid out, whereas insurance premiums cover the insured’s risks.

Nature of Coverage:

Bonds ensure contractual obligations are met, while insurance covers unforeseen damages or liabilities.