AI-powered finance: A Paradigm Shift in the Financial Sector

Money Meets Machine: The Integration of AI in the Financial World

AI-powered finance has become increasingly prevalent in the financial sector, transforming the industry in various ways. Here are some key areas where AI is making a significant impact:

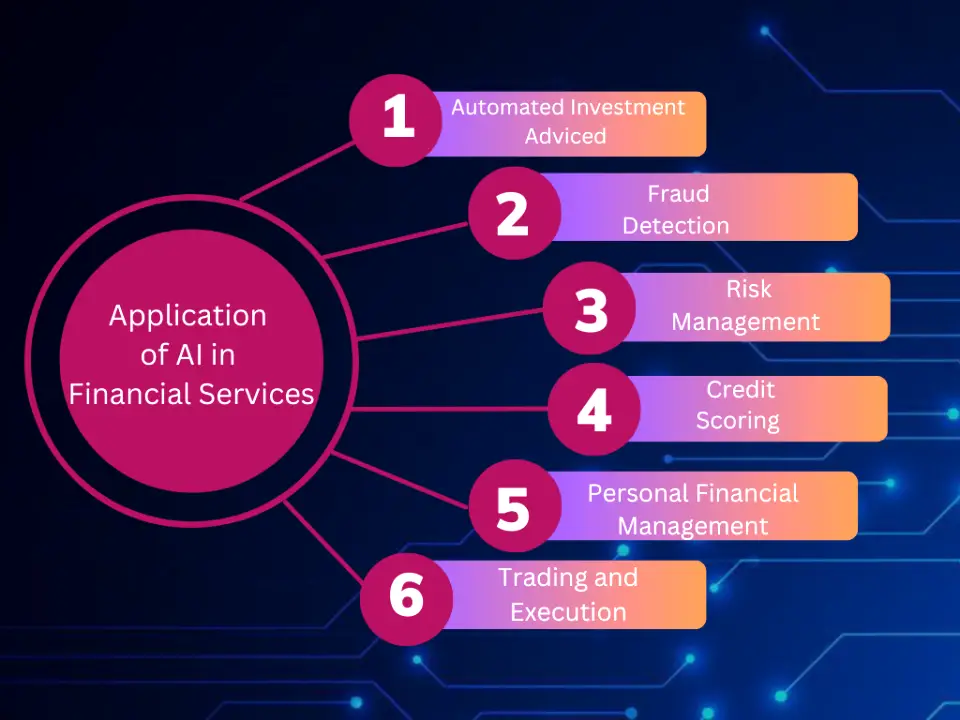

Algorithmic Trading:

AI-powered algorithms analyze market data in real time to execute trades with speed and accuracy.

Machine learning models can identify patterns and trends, helping in the development of more effective trading strategies.

Risk Management:

AI tools assess and manage risk by analyzing vast datasets and identifying potential threats.

Predictive analytics and machine learning assist in forecasting market trends and evaluating the impact on investments.

Fraud Detection and Prevention:

AI systems use anomaly detection and pattern recognition to identify unusual transactions and potential fraudulent activities.

Continuous learning enables these systems to adapt to new types of threats and evolving fraud patterns.

Customer Service and Chatbots:

AI-driven chatbots provide instant customer support, answering queries, and assisting with basic financial tasks.

Natural Language Processing (NLP) allows these bots to understand and respond to customer inquiries effectively.

Credit Scoring:

AI algorithms assess creditworthiness by analyzing a broader range of data, beyond traditional credit scores.

Machine learning models can predict the likelihood of default more accurately, leading to better-informed lending decisions.

Personalized Financial Advice:

AI-powered robo-advisors offer personalized investment advice based on individual financial goals and risk tolerance.

Continuous monitoring and adjustment of portfolios help optimize returns and minimize risk.

Regulatory Compliance:

AI assists financial institutions in staying compliant with evolving regulations by automating compliance processes.

Natural language processing tools can interpret and extract relevant information from legal documents and regulatory texts.

Data Analysis and Insights:

AI processes vast amounts of financial data to extract valuable insights and trends.

Predictive analytics helps in forecasting market movements and making informed investment decisions.

Cybersecurity:

AI enhances cybersecurity measures by identifying and mitigating potential security threats.

Machine learning algorithms can detect unusual patterns that may indicate a cyber attack, contributing to a more robust security infrastructure.

Operational Efficiency:

AI streamlines routine tasks, automating processes like data entry, reconciliation, and reporting.

Increased efficiency allows financial institutions to focus on more strategic aspects of their operations.