Insuring Tomorrow: Navigating the Future Landscape of Insurance

What is the theme of insurance in future

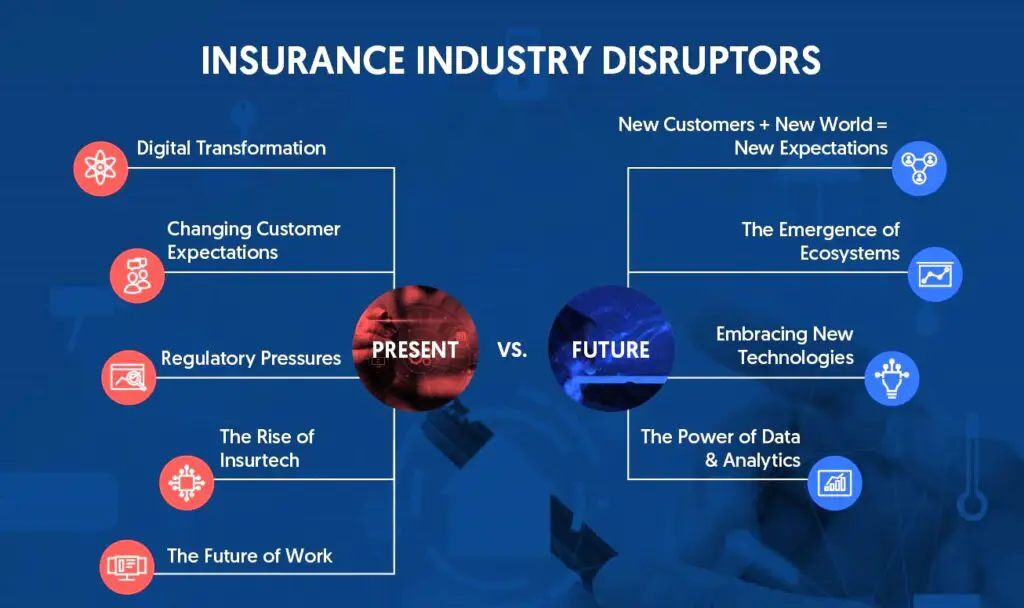

Insuring Tomorrow In an ever-evolving landscape, the future of insurance is poised for a transformation that is both inevitable and revolutionary. The emergence of cutting-edge technology has woven a tapestry of possibilities, redefining the very essence of insurance. As we traverse this juncture, it becomes paramount to comprehend the trajectory and nuances that shape the insurance sector of tomorrow.

Technological Infusion in Insurance

Artificial Intelligence (AI) and Machine Learning

The convergence of AI and insurance is nothing short of a revolution. The assimilation of AI algorithms has bolstered predictive analysis, risk assessment, and customer interaction. Through machine learning, insurers can analyze colossal data sets, decipher patterns, and make informed decisions, enhancing operational efficiency while mitigating risks.

Internet of Things (IoT) and Telematics

IoT’s integration into insurance heralds a new era of data-driven insights. Connected devices, equipped with sensors, provide real-time data on various aspects, from monitoring driving behaviors for personalized auto insurance to tracking health metrics for tailor-made health coverage.

Blockchain and Smart Contracts

The immutable nature of blockchain technology has redefined transparency and security in insurance. Smart contracts execute automatically when predefined conditions are met, ensuring seamless, fraud-resistant claim settlements.

Customer-Centric Evolution

Personalized Offerings

The future of insurance pivots on catering to individual needs. Insurers are embracing personalized policies, leveraging data analytics to craft tailor-made solutions that resonate with each customer’s unique requirements.

Enhanced Customer Experience

Technological interventions have elevated customer service standards. Chatbots, virtual assistants, and mobile apps streamline interactions, offering prompt resolutions and enhancing overall user experience.

Redefining Risk Management

Predictive Analytics

The fusion of vast data pools and sophisticated analytics tools enables insurers to foresee potential risks. Predictive analytics empowers proactive measures, preventing losses and fortifying risk management strategies.

Cybersecurity Imperatives

With the digitalization of operations, cybersecurity emerges as a cornerstone of future insurance. Insurers focus on fortifying systems, employing advanced protocols to shield against cyber threats and data breaches.

Environmental and Societal Impacts

Climate Change Resilience

Insurance is gearing up to address the repercussions of climate change. Innovative policies encompassing weather-related risks, sustainable practices, and disaster management initiatives are becoming pivotal.

Social Responsibility

The future of insurance transcends mere profit-making. Insurers are increasingly emphasizing social responsibility, supporting communities, and fostering societal well-being through philanthropic endeavors.

Regulatory Landscape and Ethical Considerations

Evolving Regulations

As the insurance landscape undergoes a metamorphosis, regulatory frameworks adapt to accommodate technological advancements, ensuring a balance between innovation and consumer protection.

Ethical and Moral Imperatives

Amidst technological leaps, maintaining ethical standards remains non-negotiable. Insurers uphold ethical considerations, ensuring fairness, transparency, and ethical practices in all facets of operations.

The future of insurance is an amalgamation of technological prowess, customer-centricity, risk mitigation, societal impact, and ethical fortitude. Embracing this evolution is not merely an option; it’s a requisite for staying relevant in an era characterized by dynamic change.