Usage-Based Insurance: In today’s fast-paced world, staying ahead of the curve is vital. The same principle applies when it comes to insurance, with the advent of Usage-Based Insurance (UBI) changing the landscape dramatically. UBI, a revolutionary approach to insurance, has transformed the way we perceive and purchase insurance policies. In this comprehensive guide, we will delve deep into the intricacies of Usage-Based Insurance, exploring its benefits, how it works, and its implications for consumers and the insurance industry.

The Basics of Usage-Based Insurance

Usage-Based Insurance, often referred to as UBI, is a groundbreaking insurance model that takes a personalized approach to pricing and policy creation. Unlike traditional insurance policies that rely on general statistical data, UBI leverages advanced telematics technology to determine premiums based on individual behavior and usage patterns.

UBI policies can be applied to various types of insurance, including:

Auto Insurance

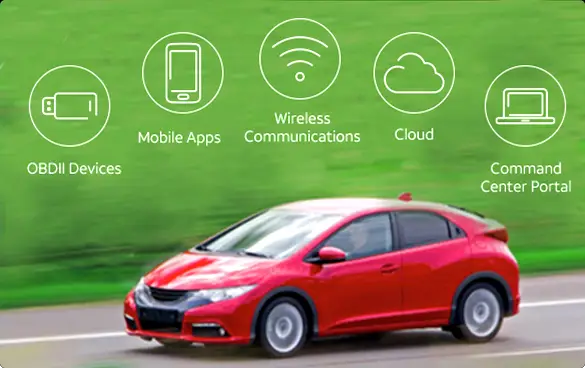

UBI has made significant waves in the auto insurance sector. With the installation of telematics devices or mobile apps, insurers can monitor how a policyholder drives, including factors such as speed, acceleration, braking, and even the time of day the vehicle is used. This data is then analyzed to determine the driver’s risk profile, ultimately influencing the cost of their insurance premium.

Home Insurance

Homeowners are not left behind in the UBI revolution. For home insurance, UBI can monitor security systems, fire detection, and even energy usage. Policyholders who take proactive steps to safeguard their homes may be rewarded with lower premiums.

Health Insurance

In the health insurance arena, UBI considers various factors, including lifestyle choices and activity levels. Policyholders who maintain a healthy lifestyle may enjoy lower premiums, creating a positive incentive for improved health.

How Does UBI Work?

The inner workings of UBI are intricate, but they boil down to data collection and analysis. Let’s break down the process:

Data Collection

The heart of UBI lies in data collection. Telematics devices, commonly referred to as “black boxes,” or mobile apps, gather a wealth of data related to your insurance coverage. For example, in auto insurance, a black box may collect information about your driving speed, frequency of hard braking, and the hours during which you typically drive.

Data Analysis

Once the data is collected, sophisticated algorithms analyze the information. Insurers use this data to create a detailed profile of your behavior and assess the associated risks. This profile forms the basis for calculating your premiums.

Tailored Premiums

With a UBI policy, your premiums are personalized to your behavior. Safe drivers, cautious homeowners, or health-conscious individuals can enjoy lower premiums, while those with higher-risk profiles may pay more.

Benefits of UBI

Usage-based insurance offers an array of advantages that make it an appealing choice for policyholders:

Fair Pricing

UBI promotes fairness in insurance pricing. Rather than being grouped with other policyholders based on general statistics, your premium reflects your individual risk. This means safe drivers no longer subsidize the riskier ones.

Incentives for Safe Behavior

UBI encourages responsible behavior. Knowing that your actions directly impact your premium, policyholders are incentivized to drive safely, protect their homes, and maintain healthy habits.

Accurate Risk Assessment

UBI allows for more precise risk assessment, benefiting both insurers and policyholders. Insurers can manage risk more effectively, and policyholders can potentially save on their premiums.

Implications for the Insurance Industry

The emergence of UBI has significant implications for the insurance industry as a whole:

Shift in Business Models

Insurers are adjusting their business models to accommodate UBI. They are embracing data analytics, telematics technology, and customer-centric approaches to remain competitive.

Customization as a Norm

UBI is pushing the industry towards customization. Insurers are now more inclined to tailor policies to individual needs, creating a more customer-centric approach.

Market Competition

With the rise of UBI, competition among insurers is intensifying. Companies are striving to offer the most attractive UBI policies to entice customers.

Conclusion:

In conclusion, Usage-Based Insurance is transforming the insurance landscape by offering personalized, fair, and data-driven policies. Whether you are insuring your car, home, or your health, UBI provides a new way to save on premiums and promotes safer and responsible behavior.